What Everybody Ought To Know About How To Deal With Credit Agencies

Don't give in to pressure to pay on first contact just as you wouldn’t jump into a contract without understanding its.

How to deal with credit agencies. Credit collections is a business transaction on both sides. Avoid phone calls, insist on written verification of the debt, and insist on conducting business with them only in a written manner. The agency wants to collect the money due, and you want to pay your debts.

Discuss your debt with anyone except you (unless you have given your. How to negotiate with creditors be honest and direct. First, it should adopt a professional code of standards that values the needs of its clients.

How to deal with double jeopardy tradelines if an original creditor and collection agency appear on your credit report, don’t fret. If a debt collection agency runs afoul. Start the conversation with your creditor by explaining why you’ve fallen behind on your payments.

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. When dealing with a collection agency, start your negotiations low. They can also help you deal with your creditors and.

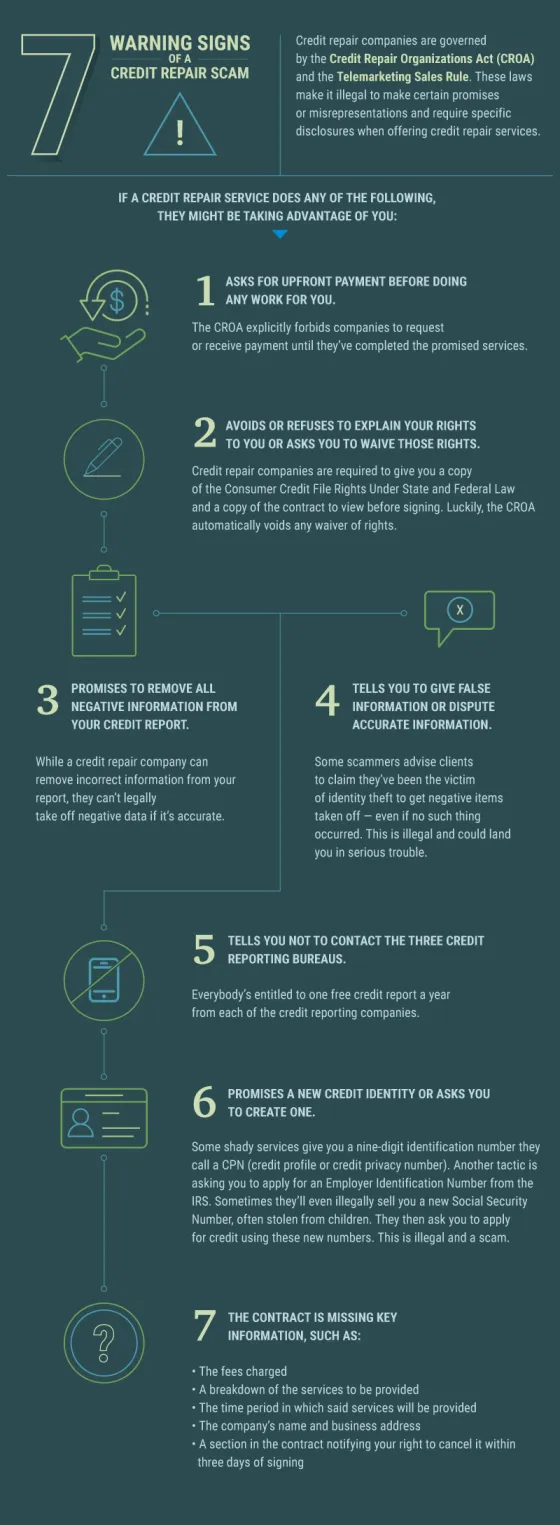

Threaten legal action if the agency does not have the legal authority and consent of the creditor to do so; The blueprint to improve credit rating agencies should map two ways forward. Get collection agencies to stop calling by asking in writing if you discover that the debt the collection agency is calling about indeed belongs to you, one way you can get a collection.

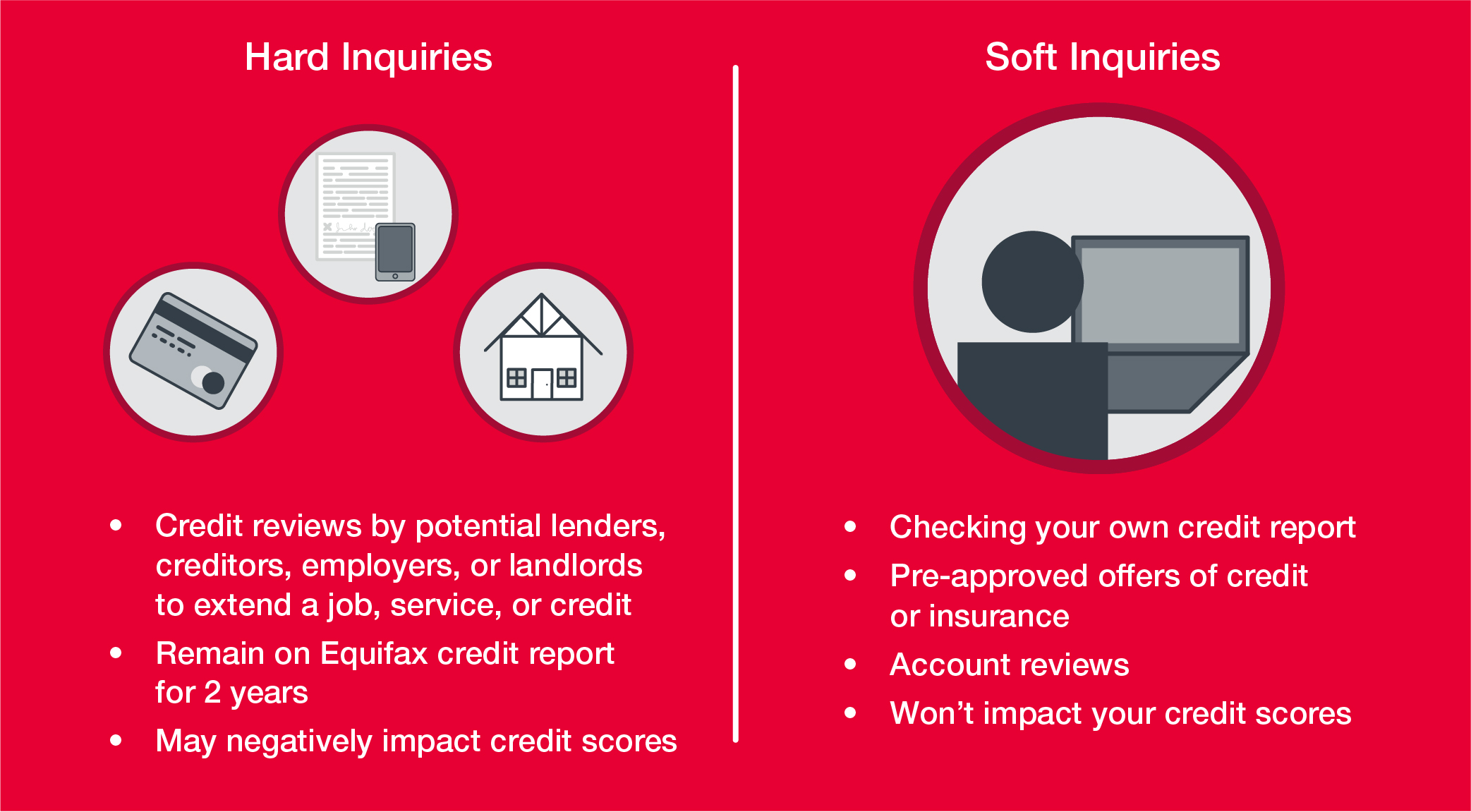

Assuming your debt hasn’t already been sold, you can contact the company you owe and negotiate repayment directly with it. A collection stays on your credit report for seven years from the time of your last payment, and there are three ways to get it taken off. 3 steps for dealing with a debt collector 1.

That could save you from dealing with collection. Before you get into a discussion with the debt collector, ask for a validation notice. How long the agency will take to provide the.

/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png)