Breathtaking Tips About How To Reduce Refinancing Closing Costs

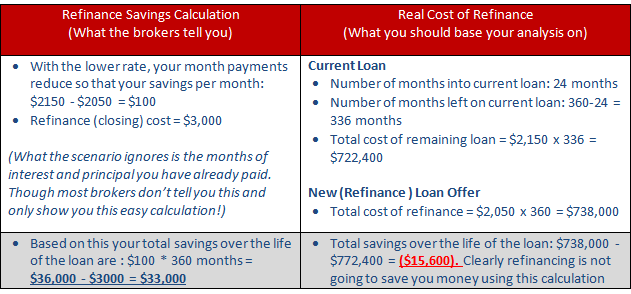

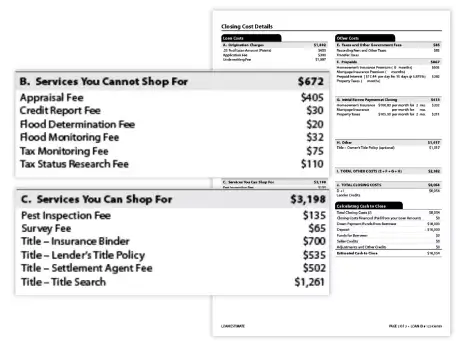

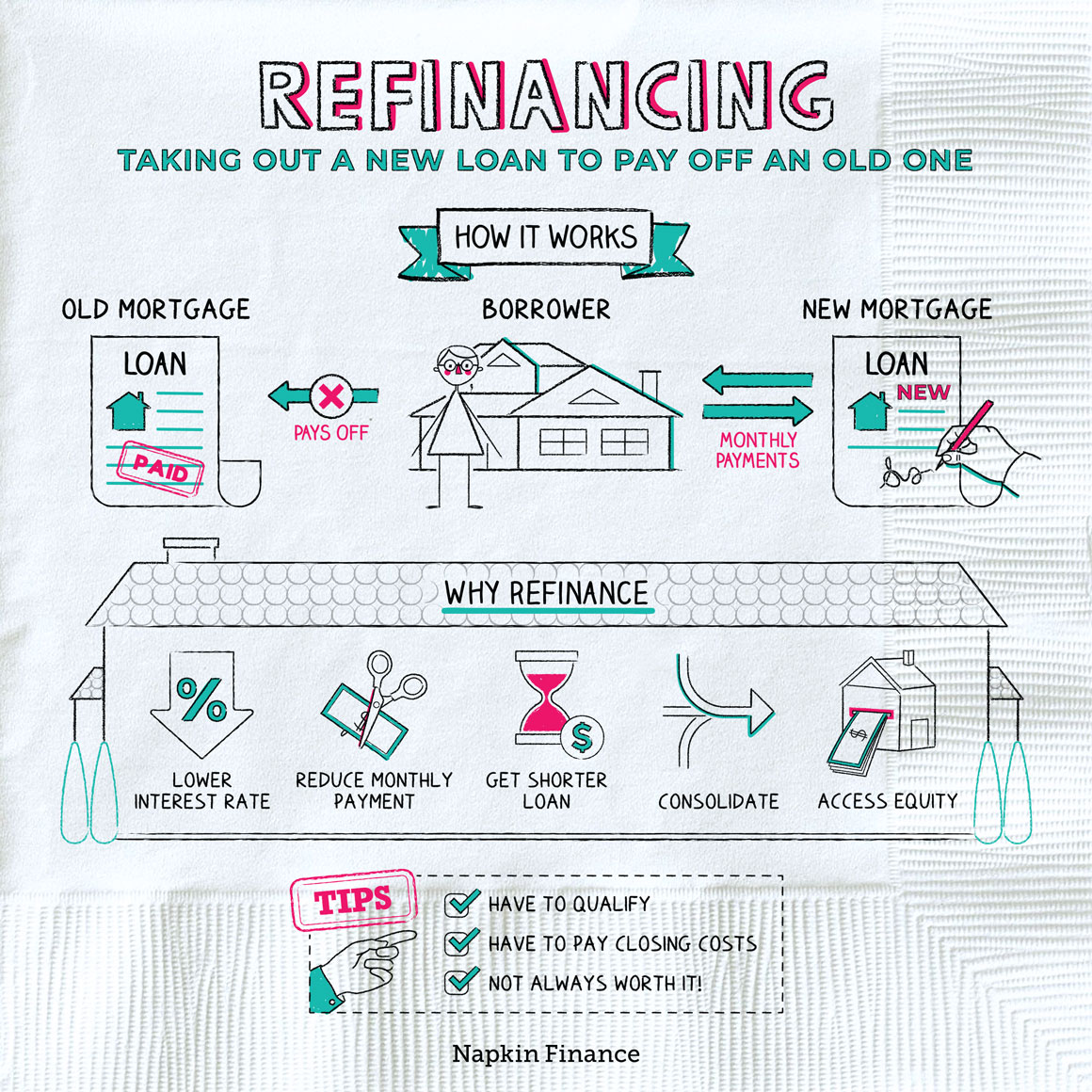

The decision to refinance hinges heavily on how much you expect to pay in closing costs.

How to reduce refinancing closing costs. Lock in lower monthly payments when you refinance your home mortgage. The company will charge $5,000 in closing costs for the refi. You can pay extra at closing to reduce your interest rate.

Ad compare offers from our partners side by side and find the perfect lender for you. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi. Ad lock your rates for up to 90 days!

Your closing costs include per diem. Take time to choose the best rate & lower your payments. 2 days agothe best mortgage refinance companies have a lot to offer homeowners, but finding the right fit will depend on a borrower’s specific circumstances.

Points generally cost 1% of your. If you can’t waive the appraisal altogether, you may be able to save money by opting for an automated appraisal instead of a full appraisal. On home purchase transactions, the buyer/borrower can ask the seller to pay for the buyer’s closing costs.

Shop around for mortgage lenders mortgage refinance lenders compete for your business just like grocery stores and. This fee is required to start a new loan application process, the cost of which varies by lender. One of the simplest ways to reduce closing costs is to simply schedule your closing date for later in the month.

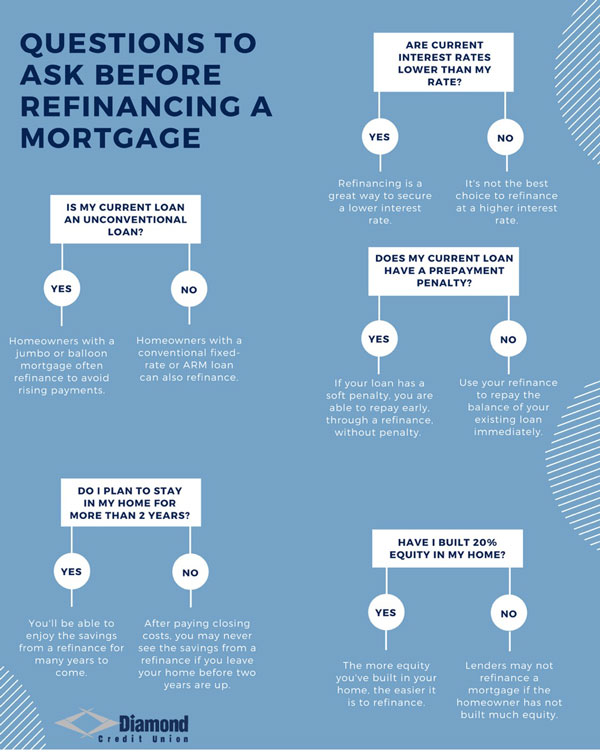

Making a large lump sum payment and asking your lender to restructure, or “recast,”. 7 tips to lower refinance costs 1. The refinance lender should give you the closing disclosure form as early on as possible.

It’s important to closely examine the fees that a potential lender is charging so that. You break even sooner with the. The average cost for this fee is between $300 and $450.

Ask your lender for an appraisal waiver. Find the best refinance option just for you. Negotiate for lower fees and a.

You can choose to reduce your interest rate by 0.25% for each point you buy. By waiting to refinance, you'll save $941 in extra. Close a loan in 25 days & start saving money

Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. This is how “no closing costs loans” are created. Compare what you see on the closing disclosure with what you see on the.